Originally posted by: Minionite

Coming from the industry of commercial real estate and residential real estate loans, I have done a lot of work on credit scores and done trainings as well. What I'm saying may differ country to country slightly, but should be helpful overall.

- The less unsecured credit you have the better - Unsecured credit is anything that isn't backed by some type of collateral, like credit cards, lines of credits, etc. You want to have about triple your regular expenses in unsecured credit to maybe 10 times. So, for example, if your monthly expenses that you pay on a credit card is $500, then you want to start at about $1,500 in credit card limits to around $5,000. The reason is that unsecured credits are the last debts to be paid if you declare bankruptcy or die. Thus, they will affect your credit score the hardest.

- Only spend what you can actually afford on your credit cards - Try not to keep any balance outstanding month-to-month. Pay off your balance before the interest period starts each month. If you do end up spending more in a month than you can pay, then cut back the following month and pay off your credit card debt immediately. Those high interest rates are only going to put into a never-ending spiral.

- Pay on time - Especially on credit cards, make those payments on time. In fact pay at least a week before the due date. Set up autopay if you can. You don't want to be late. Those really affect your credit score and it becomes hard to get back the good credit scores with even one late payment.

- Don't have too many credit cards - Find a few good ones that you can use and you can keep for a long time. And try to use each credit card at least once every month. Even if it's just to buy a coffee, use each credit card and pay it off in time. Unused credit cards don't look good on accounts. And over time they can penalize your score.

- Don't switch credit cards too often - Try to find ones that you can stick to for long periods of time. Switching 1 out of 4 every few years is fine, but don't switch all 4 every year else your credit score will get hit hard.

- For larger loans either get a broker or try not to shop around - The more searches/hits that appear on your credit score, the more likely it is to get impacted. Hence when you're going for a large loan, like a mortgage, either do some research before choosing 2 or 3 banks or get a broker. This will reduce the number of hits on your credit score thus keeping it up.

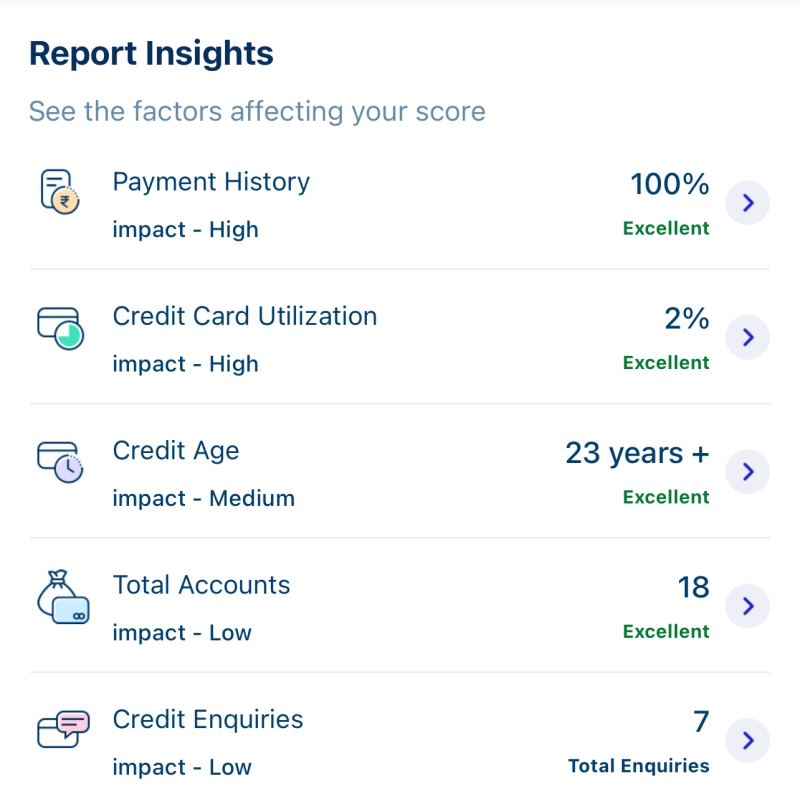

- Prepay on those large loans - Mortgages, car loans, etc. are loans that last a long-time. Making payments on time is important, but so is paying off those loans quickly. There is something known as credit utilization that affects the credit score. You want your credit utilization history to fall quickly. A $500k mortgage that you pay off over 30 years is going to keep that credit utilization high versus a $500k mortgage that you pay off over 10 years.

- Review your credit score at least once a year - Like Vijay said, you want to review your own credit score. Do that at least once a year. It gives you a sense of what is hurting your score so you can improve that, but also lets you know if there is some mistake or maybe identity theft. Sometimes it can also be a mistake by the credit score company. For example, if 2 people have the same name, it has happened where one person's credits make their way onto the other person's credit report. You want to catch those issues and resolve them quickly. My cousin's credit score once got hit badly because some guy with the same name filed for bankruptcy and the credit score company accidentally put that bankruptcy on my cousin's name. He only found out when he went for a car loan and he was getting double digit interest rates (this was in the US). Don't be that person who finds out when you are going for a loan.

- Get a student loan but pay it off before the interest starts - Many countries have student loan programs for university studies. These loans have crazy rates, but those only start on the day when you graduate. Hence in a way it is free money until the interest starts. So borrow that money, but only borrow as much as you or your parents can help you pay back before the interest starts. It helps give you a headstart on your credit score and also gives you a chance to start budgeting early.

I'm sure I'm missing some suggestions, but these are just a few that came to the top of my mind.

Hi Minionite,

Thank you for sharing your insights on credit scores and credit management. Your advice is generally very helpful. However, there are a few points that might need further clarification or adjustment:

1. The less unsecured credit you have the better:

- This is not entirely accurate. While it is true that unsecured credit can be riskier, having too little credit can negatively impact your credit score. Credit utilization ratio (amount of credit used vs. credit available) is a significant factor in credit scores. Keeping a higher credit limit and using it responsibly is often better.

4. Don't have too many credit cards:

- This is somewhat correct but can be nuanced. Having multiple credit cards can be beneficial if managed properly, as it can increase your total available credit and lower your utilization ratio. However, it is important to use them responsibly and not open too many at once.

6. For larger loans either get a broker or try not to shop around:

- This is not entirely accurate. When shopping for larger loans like mortgages, multiple inquiries within a short period (usually 14-45 days) are typically treated as a single inquiry by credit scoring models. This is to encourage rate shopping without hurting your credit score.

7. Prepay on those large loans:

- This is partially correct. While paying off loans early can lower your credit utilization and save on interest, it is not always necessary for a good credit score. Consistent on-time payments are more important for maintaining a healthy credit score.

9. Get a student loan but pay it off before the interest starts:

- This is a specific strategy that might not apply universally. While it’s true that some student loans do not accrue interest until after graduation, it’s important to borrow only what is necessary and have a solid plan for repayment..

Thanks again for your contributions to this discussion!

comment:

p_commentcount