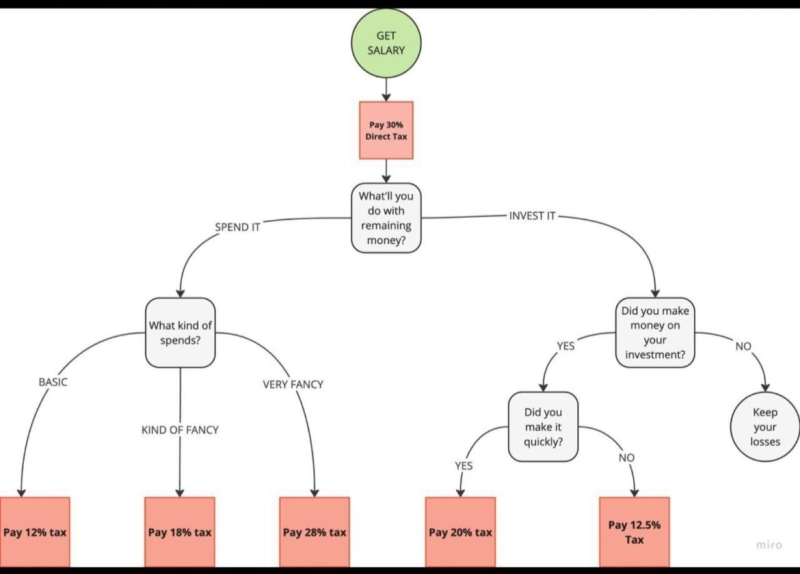

.. the jist of the budget speech

.. the jist of the budget speech

I don't have a job (had quit to become an author) , so an author would be treated as entrepreneur/sole proprietor? And what about the costs that were incurred in marketing my book and running ads? Would I get deduction?

If you have any idea, do let me know. Was earning below taxable amount at job, so had never paid taxes, so don't have idea

Originally posted by: Sneha.Narayanan

I don't have a job (had quit to become an author) , so an author would be treated as entrepreneur/sole proprietor? And what about the costs that were incurred in marketing my book and running ads? Would I get deduction?

If you have any idea, do let me know. Was earning below taxable amount at job, so had never paid taxes, so don't have idea

That makes it a business/profession yes, so you'd be treated as one.

No standard deduction then- so if your net income (gross-expenses) stays within 7L, you don't have to pay anything under the new regime. The 7L limit applies for FY 23-24 as well as FY 24-25.

Yes, marketing and ad expenses are deductible. For a standard business, lots of others things are deductible as well- internet expenses, rent (if used for business purposes), accountant's fees, depreciation on any assets purchased, travel expenses etc.

Depending on what your other investments are (mediclaim, housing loan interest), you may want to check out the old regime (FY 23-24). The new regime has a rebate till 7L, but practically takes away every deduction.

Another thing- you might want to research into section 80QQB- I'm not quite aware of the specifics, but it deals with a deduction available for certain types of royalty.

Budget explained in simple terms

That makes it a business/profession yes, so you'd be treated as one.

No standard deduction then- so if your net income (gross-expenses) stays within 7L, you don't have to pay anything under the new regime. The 7L limit applies for FY 23-24 as well as FY 24-25.

Yes, marketing and ad expenses are deductible. For a standard business, lots of others things are deductible as well- internet expenses, rent (if used for business purposes), accountant's fees, depreciation on any assets purchased, travel expenses etc.

Depending on what your other investments are (mediclaim, housing loan interest), you may want to check out the old regime (FY 23-24). The new regime has a rebate till 7L, but practically takes away every deduction.

Another thing- you might want to research into section 80QQB- I'm not quite aware of the specifics, but it deals with a deduction available for certain types of royalty.

Hey, thanks a lot.

So basically the total amount I make in a year, I have to subtract it with the amount invested liked Amazon ads, insta ads, cost paid for editing book etc, right? And then the remaining amount is what I earned (?)

And this profit has to be upto 7 lakh , then no tax right?

Did I understand it correctly, do let me know. I suck at Maths 😭

Originally posted by: Sneha.Narayanan

Hey, thanks a lot.

So basically the total amount I make in a year, I have to subtract it with the amount invested liked Amazon ads, insta ads, cost paid for editing book etc, right? And then the remaining amount is what I earned (?)

And this profit has to be upto 7 lakh , then no tax right?

Did I understand it correctly, do let me know. I suck at Maths 😭

That's indeed pretty much it.

If your net profit (income-expenses) plus any other income you may have (interest, capital gains for example) is likely to cross 7l, you may be liable to pay advance tax.

The official tax portal also has some statements that contain information about you- for example savings bank interest, FD interest, TDS deducted etc. Be sure to check that your return reflects all that information.

That's indeed pretty much it.

If your net profit (income-expenses) plus any other income you may have (interest, capital gains for example) is likely to cross 7l, you may be liable to pay advance tax.

The official tax portal also has some statements that contain information about you- for example savings bank interest, FD interest, TDS deducted etc. Be sure to check that your return reflects all that information.

Extremely helpful. Thank you for taking out time to explain

After 7 lakh taxable means I never have to pay tax in this lifetime, lol.

One more question, since the rules of business will apply to self employment, Can I get deduction/exempt for electricity bills or no? Because I don't have my own place

(I live with my parents in their house)

Just cope up with the times

https://x.com/Panditcasm/status/1815756150631023043?t=6oIYLZwSQe7qc7lmqeaqKA&s=19

Originally posted by: Sneha.Narayanan

Extremely helpful. Thank you for taking out time to explain

After 7 lakh taxable means I never have to pay tax in this lifetime, lol.

One more question, since the rules of business will apply to self employment, Can I get deduction/exempt for electricity bills or no? Because I don't have my own place

(I live with my parents in their house)

@bold- This is a bit of a grey area.

Technically you could, but the place is also used as a residential one, and the bills normally don't come separate for your "business room" in your house and the other places. You could probably consult your CA and ask him what he feels.

Fun fact- you could theoretically pay "business" rent to your family and could claim it as a deduction (but the payment needs to be real, and they need to show rent in their return too)

comment:

p_commentcount