Personal finance is a term that covers managing your money as well as saving and investing. It encompasses budgeting, banking, insurance, mortgages, investments, and retirement, tax, and estate planning.

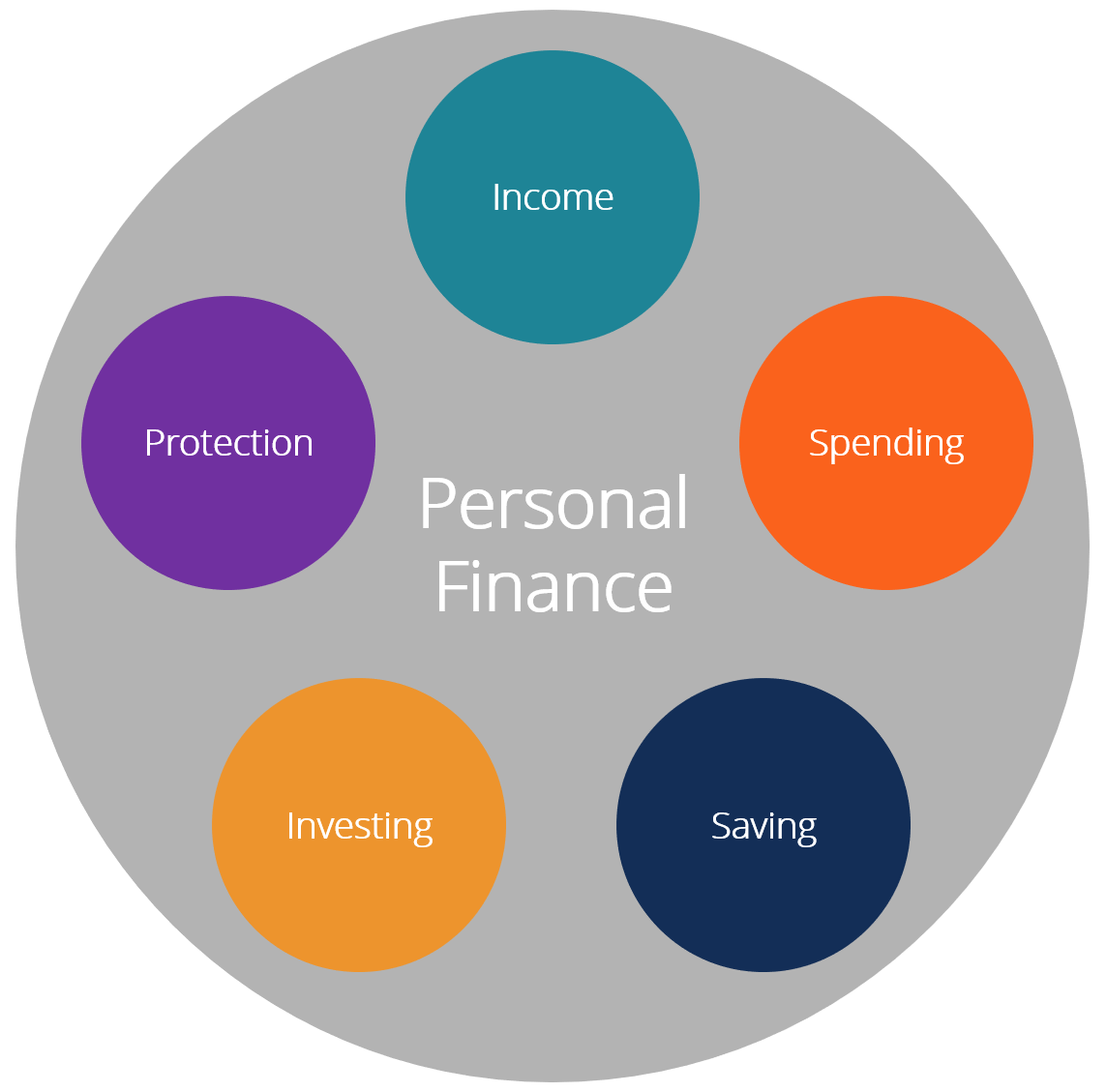

The five areas of personal finance are income, saving, spending, investing, and protection.

Income

Income is the starting point of personal finance. It is the entire amount of cash inflow that you receive and can allocate to expenses, savings, investments, and protection. Income is all the money you bring in. This includes salaries, wages, dividends, and other sources of cash inflow.

Spending

Spending is an outflow of cash and typically where the bulk of income goes. Spending is whatever an individual uses their income to buy. This includes rent, mortgage, groceries, hobbies, eating out, home furnishings, home repairs, travel, and entertainment.

Being able to manage spending is a critical aspect of personal finance.

Individuals must ensure their spending is less than their income; otherwise, they won't have enough money to cover their expenses or will fall into debt. Debt can be devastating financially, particularly with the high-interest rates credit cards charge.

Saving

Savings is the income left over after spending.

Everyone should aim to have savings to cover large expenses or emergencies. However, this means not using all your income, which can be difficult. Regardless of the difficulty, everyone should strive to have at least a portion of savings to meet any fluctuations in income and spending—somewhere between three and 12 months of expenses.

Beyond that, cash idling in a savings account becomes wasteful because it loses purchasing power to inflation over time. Instead, cash not tied up in an emergency or spending account should be placed in something that will help it maintain its value or grow, such as investments.

Investing

Investing involves purchasing assets, usually stocks and bonds, Fixed Deposits to earn a return on the money invested/ deposited. Investing aims to increase an individual's wealth beyond the amount they invested. Investing does come with risks, as not all assets appreciate and can incur a loss.

Investing can be difficult for those unfamiliar with it—it helps to dedicate some time to gain an understanding through readings and studying. If you don't have time, you might benefit from hiring a professional to help you invest your money.

Protection

Protection refers to the methods people take to protect themselves from unexpected events, such as illnesses or accidents, and as a means to preserve wealth. Protection includes life and health insurance and estate and retirement planning.

Be judicious while spending, be clever while investing, and always be safe while saving your hard-earned money. That is my personal advice.

comment:

p_commentcount