I'm curious about that rooftop solar installation scheme mentioned in the budget. If implemented properly it will be a very good initiative.

I'm curious about that rooftop solar installation scheme mentioned in the budget. If implemented properly it will be a very good initiative.

I think there won't be any problem with part, they are villages where this have been implemented successfully, they know the drill and they have the resources.Originally posted by: NathuPaapi

I'm curious about that rooftop solar installation scheme mentioned in the budget. If implemented properly it will be a very good initiative.

Really a good initiative, giving electricity to remote areas without adding burden on limited resources

Throughout the Budget Speech, I kept an eye on the movements of the stock market. It moved like a jigsaw puzzle, alternating between red and green! I've indulged in trading and earned a good amount!

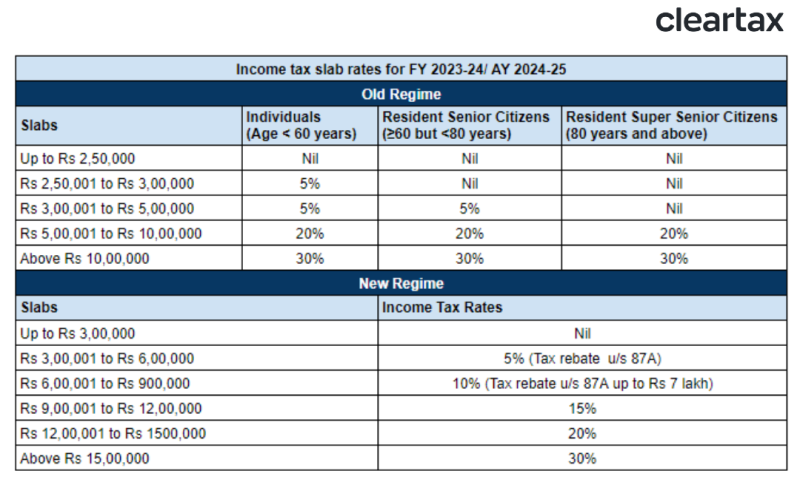

When Piyush Goyal announced the interim budget in 2019, individual taxpayers with taxable yearly income up to Rs 5 lakhs would not be obliged to pay any income tax. He stated that if a person invests in provident funds, designated savings accounts, insurance, and other things, they are exempt from paying income tax up to a gross income of Rs 6.50 lakhs. Additional deductions were also allowed under the plan, including interest on house loans up to Rs 2 lakh, interest on school loans, contributions to the National Pension Plan, health insurance, and senior citizen medical expenses.

Budget 2023 pushed to make the new income tax regime the default option. The basic exemption limit was hiked up to Rs 3 lakh from Rs 2.5 lakh under the new income tax regime. Income tax slabs in the new tax regime were tweaked as well. A rebate under Section 87A was increased under the new tax regime from the current income level of Rs 5 lakh to Rs 7 lakh. So those opting for the new income tax regime and having an income up to Rs 7 lakh will not pay any taxes.

Budget 2023 also tweaked the tax slabs under the new income tax regime. There is no tax on income up to Rs 3 lakh. Income above Rs 3 lakh and up to Rs 5 lakh, will be taxed at 5 percent. For incomes above Rs 6 lakh and up to Rs 9 lakh, tax rate is 10 percent. For over Rs 12 lakh and up to Rs 15 lakh, income is taxed at a 20 percent rate. For those who have a taxable income of more than Rs 15 lakh, a 30 percent income tax rate is applicable. It is very similar to the tax systems of Western countries.

The Finance Minister didn't announce any major income tax announcements. The tax rates were kept unchanged. The government has extended the deadline for certain tax benefits to startups and exemptions to specific IFSC units to March 2025.

Key Budget 2024-25 major announcements:

FM has adopted an aggressive fiscal consolidation target. She has announced an FY25 fiscal deficit target of 5.1% as against the expectation of 5.3% levels. In FY24, the fiscal deficit target of 5.8% has been achieved thanks to better revenue mobilization than the target of 5.9%.

FM announced a scheme for housing for the middle class to encourage those living in rented houses, slums, and unauthorized colonies to buy or build their own house.

More medical colleges are to be set up using existing infrastructure

Healthcare cover under Ayushman Bharat scheme is to be extended to all Anganwadi workers and helpers. This is a very good initiative, and will garner a certain amount of votes!!

Efforts to boost farmers' income will be stepped up. This is a much needed one.

Government to promote private investment in post-harvest activities

F M Sitharaman announced the withdrawal of outstanding disputed tax demands. The move is set to benefit 1 crore taxpayers.

In a disappointment for the taxpayers, the FM chose to keep the tax rates unchanged in the interim budget for 2024, including import duty. However, certain benefits to start-ups and tax exemptions for certain IFSC units expiring in March will be extended to March 2025.

FM announced three major economic railway corridor programs under PM Gati Shakti: energy, mineral, and cement corridors; port connectivity corridors; and high traffic density corridors.

This interim budget has three good things about it. One is that they have signaled stability by not making any changes. Despite the fact that this budget is temporary, they have pledged to follow India's economic trajectory, which has been established by higher infrastructure spending.

They have given that signal and promise. Third is by containing the fiscal deficit, maybe not to 4.5 but to 5.1, to signal that we will be fiscally responsible while doing all this. And of course, we will see that nobody is left behind and inclusiveness for women and for those who are downtrodden. And there's also been space in this thing. So I think overall, they've tried to balance a very difficult act. And what they've done in the last five years, despite the difficulties of COVID, the supply chain disruption, wars, etc., they've done well, and they have given us a promise that they will continue to do that and they will make the necessary reforms to excite private investment. And following that, our public sector.

Market mood dependency: Post-budget sentiment is closely linked to the market mood two days prior to the budget announcement. Over the last five interim budgets, the market’s performance after five days mirrored the trend set two days before the budget.

Recent dampening: The last two interim budgets experienced a subdued impact on the market on the budget day, but they recovered after a week.

In this interim budget, the Finance Minister has once again delivered a responsible, innovative, and inclusive budget. This budget places emphasis on fiscal products and gives room for private capital investment into the growth of India. Continuing with the trends of the last 10 years, the FM once again lays on the foundation for a very strong path for India, with due focus on areas of national importance. She is doing a good job in all these difficult years.

Tomorrow, I am sure, the market will be flat after the budget euphoria is over!

I have a doubt, can someone explain taxes. As in, till how much income if you earn, you don't need to pay taxes?

IT slab👇Originally posted by: AuthorSneha

I have a doubt, can someone explain taxes. As in, till how much income if you earn, you don't need to pay taxes?

comment:

p_commentcount